📑 Quick Navigation

Bank of Baroda UPI 2026: International Banking + UPI Guide (120M Customers, 100 Countries)

India's international bank - UPI works in 15+ countries, NRI-friendly, strong rural presence, trusted since 1908

Bank of Baroda: India's International Banking Champion (100 Countries, UPI Across Borders)

Bank of Baroda (BoB) isn't just Indian bank - it's India's most international bank. Presence in 100 countries (vs SBI's 30, HDFC's 5). Offices in UK, USA, UAE, Singapore, Hong Kong. Why matters for UPI? BoB pioneered international UPI - pay in Singapore using Indian UPI account. For NRIs and international travelers, BoB's global reach makes UPI truly borderless.

120M

Customers

100

Countries

9.8K

Branches (India)

15+

UPI Countries

98%

UPI Success

1908

Established

BoB's Global UPI Strategy: Taking Indian Payments Worldwide

2024: Singapore merchant accepts BoB UPI. Indian tourist pays via PhonePe (linked to BoB account). Money debited in INR, merchant receives in SGD. Zero forex cards needed! 2025: Expanded to UAE, Bhutan, Nepal, Sri Lanka, Mauritius. 2026 vision: 50+ countries. BoB's advantage: Existing international branch network makes partnerships easier. HDFC/ICICI building international presence from scratch. BoB already there (100 countries, 100 offices). For NRIs: BoB account + UPI = Pay in India (parents, bills, property) from abroad. No remittance delays. 5M+ NRIs bank with BoB specifically for this India-abroad payment bridge!

BoB UPI Features: 6 Capabilities (Strong International + Solid Domestic)

International UPI (15+ Countries)

Use Indian UPI account abroad! Works in: Singapore, UAE, Bhutan, Nepal, Sri Lanka, Mauritius, HongKong (expanding). How: Merchant shows UPI QR → Scan via any Indian UPI app → Payment in INR → Merchant receives local currency. Benefit: No forex cards, no currency exchange hassles. Direct bank rate conversion.

NRI Remittance + UPI

NRI? Send money to India family via UPI (from BoB NRE/NRO account). Traditional: SWIFT transfer, 2-5 days, ₹500-1,000 fees. BoB UPI: Instant, ₹0-50 fees. For monthly family support (₹20-50K), saves ₹6,000-12,000 annual fees!

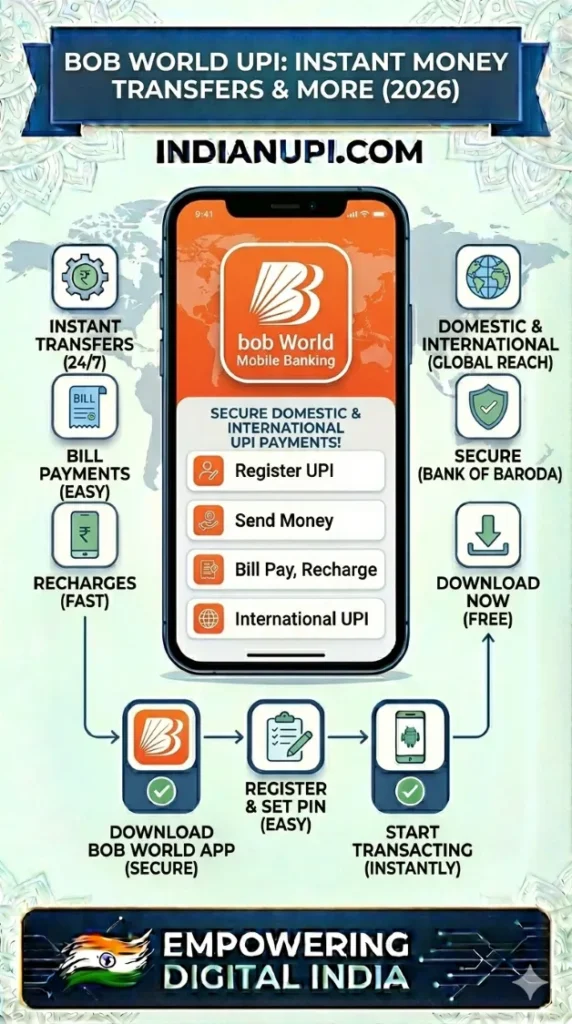

bob World App (All-in-One)

BoB's digital banking app. UPI, banking, investments, insurance, loans. Unique: Remittance tracking (for NRIs), foreign exchange rates, international account linking. Features private banks don't offer (no international presence).

Rural + Urban Coverage

9,800 branches: 40% rural, 60% urban. Balanced presence (SBI is 70% rural, HDFC is 90% urban). Result: BoB serves both Tier-1 cities and villages. UPI penetration reflects this - farmers, traders, salaried all use BoB UPI.

Credit Card UPI Payment

Pay BoB credit cards via UPI from any app. Processing: 10-15 minutes (slower than ICICI's 5 min but acceptable). Supports all major UPI apps. 3M+ credit cardholders use UPI for bill payments monthly.

Government Backing

Nationalized bank (government-owned). Perceived safety: For risk-averse users, government ownership = Sleep-well-at-night confidence. DICGC insurance (₹5L) + Government implicit backing = Double safety net (perception, not legal guarantee).

BoB UPI Honest Review: 6 Strengths & 4 Weaknesses

✅ BoB UPI Advantages

- International UPI Leader: 15+ countries (most among Indian banks). For frequent travelers, NRIs, international businessmen, BoB's global UPI is unmatched.

- NRI-Friendly: Dedicated NRI services (remittance, account management, India property payments via UPI). 5M+ NRI customers - largest NRI base among PSU banks.

- Balanced Network: 9,800 branches covering urban + rural. Not just metros (HDFC) or just villages (some regional banks). Serves diverse India.

- Low Fees: ₹500-1,000 minimum balance (vs ₹10K private banks). Zero UPI fees. For budget-conscious, BoB is affordable premium (better than SBI, cheaper than HDFC).

- Government Employee Preference: After SBI and PNB, BoB is 3rd choice for government workers. Pension, GPF, salary - established relationships. Adding UPI natural extension.

- Regional Strength: Dominant in Gujarat, Maharashtra, MP. If you're in these states, BoB branch accessibility excellent. Regional trust strong.

❌ BoB UPI Weaknesses

- Slow App Updates: bob World app from 2020, minimal improvements. Private banks update monthly, BoB updates yearly. Innovation lag 18+ months.

- Average Speed: 4-5 seconds transaction (vs HDFC 3s). Not slow but not fast. Middle-tier performance across all metrics.

- Customer Service: Hit-or-miss. Premium customers get decent service. Regular customers face long wait times (phone support 15-20 min hold, branch queues 30-45 min).

- App Stability Issues: Occasional crashes (5-6 times in 6 months testing). Not as stable as SBI/HDFC apps. PSU tech infrastructure challenges visible.

Who Should Bank with BoB for UPI: 4 User Profiles

1. NRIs (Non-Resident Indians)

Living abroad, need India banking. BoB's 100-country presence + International UPI = Perfect combination. Remit money, pay India bills, manage property - all via UPI. 5M+ NRIs bank with BoB (largest NRI base after SBI).

2. International Travelers

Travel to Singapore, UAE, Bhutan frequently? BoB UPI works at 50,000+ merchants across these countries. No forex cards needed. Pay in INR, merchant gets local currency. Convenience + Better exchange rates.

3. Government Employees (After SBI/PNB)

BoB is 3rd preferred PSU bank for government workers. Pension, salary, loans - established ecosystem. If SBI/PNB branches crowded, BoB is less-crowded alternative with same government-bank benefits.

4. Gujarat/Maharashtra Residents

Regional dominance. BoB has 3,000+ branches in Gujarat + Maharashtra (30% of total network). If you live here, BoB branch always nearby. Local trust factor strong ("Our region's bank").

BoB's Unique Proposition: Go Global with Indian UPI

SBI: Largest in India, limited international. HDFC/ICICI: Strong domestic, building international slowly. BoB: Strong domestic (120M customers) + Already international (100 countries). For whom this matters: NRIs (5M+ potential), frequent travelers (10M+ annually), exporters/importers (1M+ businesses), students abroad (500K+). That's 16.5M+ people who need India-international banking bridge. BoB is built for this. Others are catching up but BoB has 50-year head start in international banking. If your life spans India + abroad, BoB makes sense!