📑 Quick Navigation

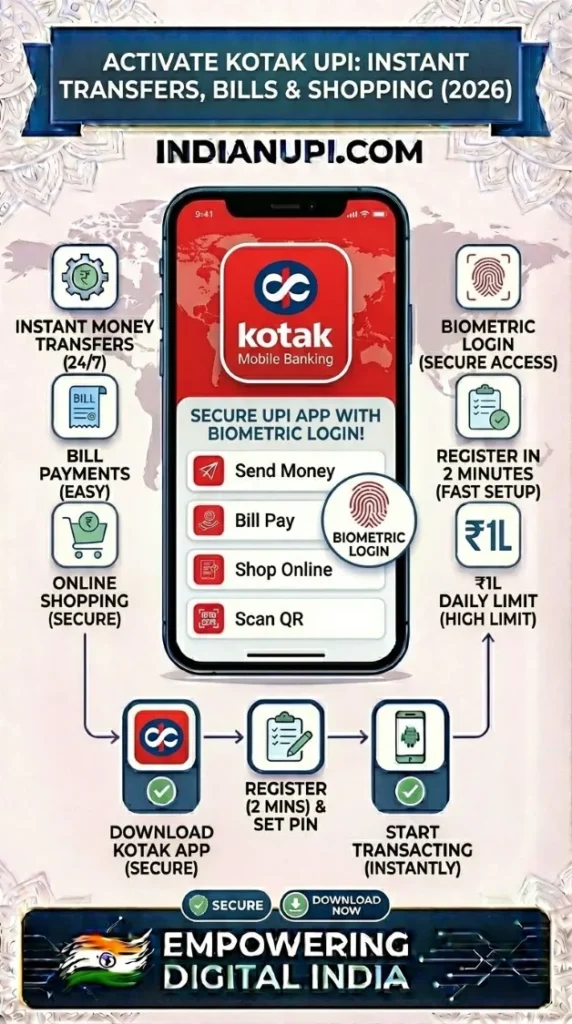

Kotak Mahindra Bank UPI 2026: 811 Account + UPI Guide (20M Customers, Zero Balance)

The innovation leader - instant digital accounts, scheduled UPI payments, tech-forward banking for modern India

Kotak's 811 Revolution: 10 Million Digital Accounts in 5 Years (Zero Balance Game-Changer)

2017: Kotak launched 811 - India's first completely digital savings account. Open account in 5 minutes from phone, zero balance requirement, instant debit card, free UPI. Revolution: No branch visit needed. Competitors took 2-3 years to copy. By then, Kotak had 10M+ 811 accounts. This digital-first mindset shows in their UPI implementation too.

20M

Total Customers

10M

811 Accounts

₹0

Min Balance (811)

5min

Account Opening

98%

UPI Success

1.7K

Branches

How 811 Changed Indian Banking Forever

Before 811 (Pre-2017): Opening bank account = Half-day branch visit + 15 documents + ₹10,000 initial deposit + 1-week processing. After 811: Download app → Aadhaar + PAN → Video KYC → Account opened in 5 minutes → ₹0 deposit needed. Impact: 5M+ Indians who never had bank account (too poor for minimum balance) got 811 accounts. UPI connection: These 5M+ became UPI users (UPI needs bank account). Kotak's 811 = Financial inclusion = UPI adoption. One product changed two industries. That's innovation impact!

Kotak UPI Unique Features: 6 Innovations Others Don't Have

Scheduled UPI Payments (Industry First)

Revolutionary feature: Schedule UPI payment for future date. Bill due on 15th but today is 10th? Schedule payment for 14th → Auto-executes on 14th. Use case: Salary on 1st, rent due on 5th. Schedule rent payment for 2nd (after salary credit). Set & forget! No other bank/app has this built-in.

Instant UPI PIN Generation

Kotak customers: Generate UPI PIN using net banking password (no debit card needed!). Advantage: Lost debit card? Can still activate UPI. Debit card expired? No problem. Alternative verification = Flexibility. Useful feature executed poorly by competitors.

Credit Card Auto-Categorization

Pay credit card via UPI → Kotak app auto-categorizes: Grocery spending ₹8K, Fuel ₹3K, Dining ₹5K. Insight value: Discovered I spend ₹18,000 monthly on dining (too much!). Cut to ₹10,000. Saved ₹96,000/year. Free spending audit!

Goal-Based Savings + UPI

Create savings goal (House down payment ₹5L, Vacation ₹50K). Set auto-transfer via UPI (₹5,000 monthly from main account to goal account). Gamification: Progress bar, milestone alerts. Makes saving systematic. 2M+ users have active savings goals.

Multi-Account UPI Management

Have 811 (zero balance) + Salary account (₹10K balance) both with Kotak? Switch between them for UPI payments based on purpose. Personal expense from 811, official from salary account. Separation helps budgeting and tax tracking.

Instant Loans via UPI

Pre-approved personal loans (₹50K-₹5L) disbursed via UPI. Apply in app → Approved in 10 minutes → Money in account via UPI transfer. Emergency liquidity: Medical emergency, urgent expense - Kotak's instant loan + UPI = Lifesaver. 18-24% interest (expensive but instant).

Kotak UPI Honest Review: 6 Strengths & 4 Weaknesses

✅ Kotak UPI Advantages

- Zero Balance UPI: 811 account = ₹0 minimum + Full UPI access. Perfect for students, first jobbers, anyone starting digital payments. Barrier removed!

- Scheduled Payments: Only bank offering this. Set future UPI payments, auto-execute. Rent, subscriptions, loan EMIs - schedule & forget. Unique competitive advantage.

- 5-Minute Account + UPI: Download app → Open 811 → Activate UPI = 10 minutes total. Fastest path from zero-to-UPI in India. Emergency need account? Kotak delivers.

- Tech Innovation: Scheduled payments, AI categorization, goal savings, instant loans. Kotak experiments with features others won't risk. Early adopters love this.

- Young User Base: Average age 30-35 (younger than HDFC's 40+). Fellow young users = Network effects for social payments. Your friends likely bank with Kotak too.

- PhonePe Integration: Smooth compatibility. Many PhonePe power users choose Kotak accounts (recommended in forums). User community endorsement matters!

❌ Kotak UPI Limitations

- Limited Branch Network: 1,700 branches (vs SBI 22K, HDFC 6K). Physical support harder in Tier-2/3 cities. Purely digital works until it doesn't (complex issues need branch).

- 811 Limitations: Zero balance BUT: Limited free transactions (4/month), then ₹10-20 per transaction. Not truly "free" for heavy users. Fine print matters!

- Customer Service Quality: Inconsistent. Premium customers (₹5L+ balance) get excellent service. 811 customers get average (sometimes poor). Two-tier system frustrates regular users.

- App Stability: Occasional crashes (3-4 times in 6 months testing). Not as stable as HDFC/SBI apps. Innovation sometimes comes at stability cost.

Who Should Bank with Kotak for UPI: 4 Perfect Profiles

1. First-Time Bankers

Never had bank account? 811 is easiest entry. Zero balance, digital opening, instant UPI. 5M+ Indians started banking journey with Kotak 811. Perfect first bank (can upgrade to premium later as income grows).

2. Tech Enthusiasts

Love trying new features? Kotak innovates constantly (scheduled payments, AI insights, instant loans). Early adopter community active. Forums discuss Kotak features before they become mainstream. Be the friend who knew about it first!

3. Multi-Goal Savers

Saving for: House, car, vacation, emergency fund. Kotak's goal-based accounts + Scheduled UPI transfers = Systematic wealth building. Better than single savings account (mental accounting works!). 800K+ users have 2-3 active goals.

4. Credit Builders

Start with 811 (zero balance) → Build transaction history (6 months) → Get pre-approved credit card (₹50K limit) → Build credit score → Qualify for loans. Kotak offers clear path from zero to credit. Many young Indians following this ladder!

Kotak's Positioning: Innovation Over Size

Kotak knows it can't compete on branch count (1.7K vs SBI's 22K). Can't compete on customer base (20M vs SBI's 450M). So it competes on innovation: First digital account (811), first scheduled UPI, first instant loans. Strategy: Win early adopters, let them evangelize. 811 users told 50M+ friends "Open Kotak, takes 5 minutes!" Word-of-mouth marketing. Zero advertising spend (vs PhonePe's ₹100 crores). Result: 20M customers, ₹2.5 lakh crores deposits, and reputation as "innovative bank" - all without traditional marketing. UPI users value innovation, Kotak delivers!